The recent Nassau County School Board budget workshop and regular board meeting was taken off track as community members expressed concerns over what the unexpected millage rate increase did to recent tax bills.

Nassau County community member and landlord Howard Claus brought his property tax bill to the NCSB budget workshop and explained, due to the unexpected increase, he had to increase the rent for his tenants in several rental properties he owns.

NCSB asked the community to consider a one-mill increase in a referendum on the voting ballot in the fall of 2022. The estimated millage increase that was presented to the community was based on assessed property values at the time of the election. Voters approved the increase.

What was not forecasted last fall was an unexpected increase in recent assessed property values in Nassau County as the county continues to grow. Because of this increase, the NCSB will expect $19 million from the millage amounts instead of the projected $13 million. This not only increased funding for the school board budget, but Nassau County taxpayers received higher than expected property tax bills in the mailbox over the past several weeks.

“We know there have been concerns expressed from folks receiving their property tax appraisals and see there have been some significant increases,” said Assistant Superintendent Mark Durham. “We want to spend a little time and explain how it works and what happened, the best we can.”

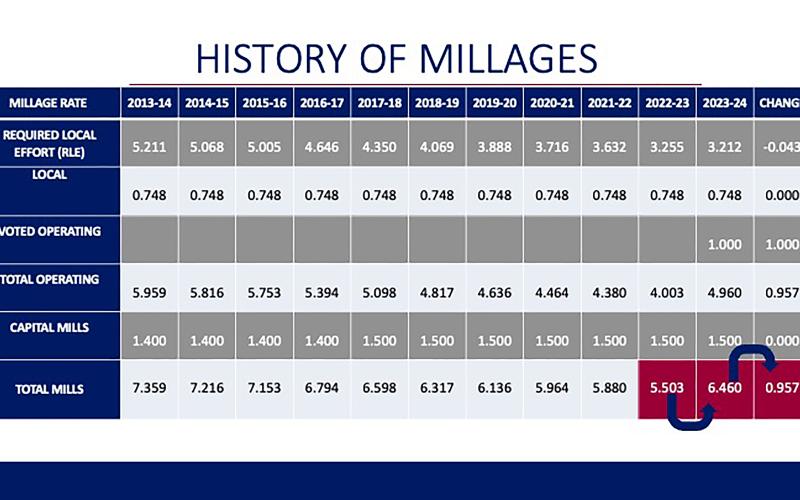

In a slide presentation, Durham highlighted information on the history of millages since 2013. According to the data, from 2013 to 2022 the average millage had a history of minimal change, fluctuating from a zero increase to a 1% change consistently over the past 10 years.

“We did not anticipate this big of an increase, I don’t know how we would have or if we should have in promoting it to the community,” said Durham. “In promoting it to the public, we used the value that we had at that time.”

The millage increase will address employee compensation with 70% of the added revenue going to teacher pay. The remaining funds are slated for safety initiatives at 12%, 9% to the arts and 9% to athletics.

“I would like to say again that the one mill is solely for, whether we come out to have $13 million or $19 million, has to go to specifically what we approved it to go to,” said NCSB Chair Cynthia Grooms after further discussion. “It doesn’t matter how much money it is, it is one mill.”

Scott Hodges, Human Resources director for the district, took a few minutes to explain, specifically to the attendees of the meeting and those watching the meeting video, why it’s important for the school to keep the increased funds in the budget.

“The board does not have discretionary funds,” explained Hodges. “With growth comes the need for more teachers, more transportation, more gas money to fuel the buses. The schools need the money.”

A final public hearing will be held on Sept. 11 for the board to vote on the presented millage and the 2023-24 budget.

tdishman@fbnewsleader.com